Before diving into this example, it’s important to stress that this is a hypothetical illustration, not a prediction. Career progression in regulatory reporting, like in any field, depends on a multitude of personal and organisational factors. These include an individual’s work ethic, technical competence, relationship-building skills, appetite for responsibility, and even timing and luck. The opportunities available at a given bank, the state of the regulatory landscape, and changes in market conditions can all play a role in shaping someone’s career journey.

Nonetheless, when you’re just starting out on your career journey it’s helpful to see where your career could go.

If you’d like to see the latest salary trend analysis for Regulatory Reporting roles, check out this post.

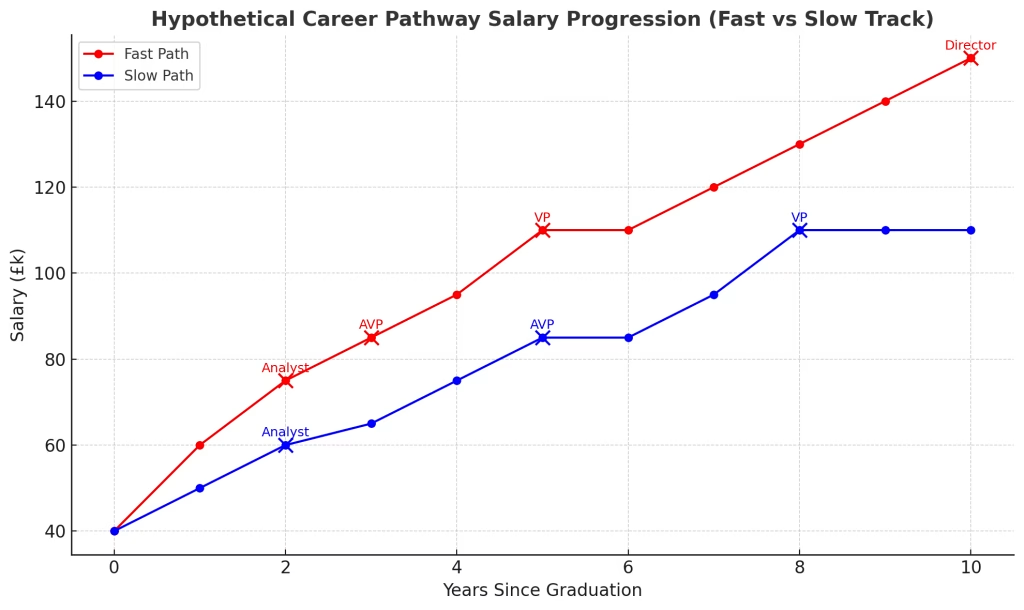

The chart above outlines two potential career trajectories for a graduate entering regulatory reporting at a UK bank in 2025. Both individuals start with the same graduate salary, but their journey through the ranks from Analyst, Assistant Vice President (AVP), Vice President (VP), and ultimately Director varies significantly.

The fast path professional moves through promotions quickly, reaching Director level within a decade. This pace might be driven by a combination of factors: exceptional technical skills, strong stakeholder management, visibility on high-profile projects, and perhaps an appetite for relocating or taking on demanding assignments. In some cases, fast progression is aided by the bank’s internal mobility programmes, sponsorship from senior leaders, or a willingness to move between institutions to secure step-up roles.

The slow path professional, meanwhile, progresses more gradually. This could be by choice and valuing stability, preferring to specialise deeply in a particular area of reporting, or balancing work with personal commitments. In other cases, slower progression might stem from limited opportunities for promotion in their department, organisational restructuring, or fewer openings at higher grades.

It’s important to note that both paths are realistic and neither is inherently better. The fast path offers earlier access to senior salaries and leadership influence, but may come with increased workload, pressure, and risk. The slow path can allow for deeper skill development, work-life balance, and reduced stress, albeit with a later arrival at the top roles. In reality, your working life will last 40-50 years, so being a few years behind the people you graduated will be insignificant in the grand scheme of things.

Regardless of speed, regulatory reporting remains a lucrative career choice. Even those progressing more slowly can double or triple their starting salary within a decade, reflecting the high value banks place on professionals who can navigate complex regulatory frameworks and deliver accurate, timely reports to the PRA, FCA, and other authorities.